Secured transactions are transactions where payments, typically on a loan of some kind, are secured by certain goods, called collateral, being subject to seizure upon failure to make payment. Mortgages, pawnshop loans, and money judgments from a lawsuit are all examples of secured transactions. Like most kinds of financial accumulation, they are speculative – they do not have the capital and may not get the capital depending on the circumstances. That risk however is mitigated by the ability to foreclose on the collateral to the loan and subsequently liquidating or reselling it to recover some, all, or even a surplus of the money owed.

Such transactions are ones that modern orthodox economists like to point to as too complicated or too attenuated from the labor theory of value for Marxist economics to explain. This reasoning comes from a misunderstanding of the labor theory of value – Marx never asserted that capital accumulation only comes from the immediate exploitation of wage labor. But even in these transactions, the value realized can always be traced back to its creation by labor. Loans are a paradigm of the neoclassical fiction of economics: the debtor benefits from having more capital in the short term to spend and the creditor benefits from making a profit, either on the interest or on foreclosing on the collateral and reselling it (admittedly this is a gross oversimplification, but nonetheless is the core of the profit motive). It seems to be win-win. And that is certainly how these transactions are marketed to consumers:

Even the more left-leaning liberal economists who criticize the ultra-predatory forms of secured transactions like rent-to-own and subprime mortgages nevertheless extol the virtue of low-income people having access to credit. After all their odd dogmatic maxim, used in arguing everything from raising the minimum wage to the earned income tax credit, is that increasing consumer spending is the great snake oil cure for all economic ails. They even frame access to credit as an issue of formal equality.

Generally extension of credit is criticized by legal scholars based on the means by which credit is extended (such as the theory of improvident extension of credit that consumer advocates in legal scholarship valiantly but haplessly pursued in the past few decades). But Marxist economics can provide a better analysis of secured transactions and the laws, like Article 9 of the Uniform Commercial Code, that govern them in the United States. And that analysis reveals it is not merely the “predatory” subprime secured transactions that are problematic. Through a Marxist lens, security interests and the legal posture towards them reveals that extension of credit cannot occur in capitalism without exploitation.

One concept of Article 9 is especially useful for demonstrating the place of secured transactions in the circuit of capital accumulation as outlined by Karl Marx in Capital: the prioritization of purchase money security interests.

Buyer’s Recourse

The purpose of securing transactions is to mitigate the risk of the debtor failing to make payments. The collateral does not need to be specifically identified nor does it need to be currently owned by the debtor: in fact a common collateral for business debtors is current and future inventory.

But what happens when more than one lender has identified debtor’s goods as collateral in their respective transactions? This issue is called priority. Generally the debtor does not have sufficient collateral to satisfy all their obligations, so creditors are very concerned about being first in line to collect (or in the modern era, to sell that right to collect to third party debt collectors). Identifying priority is an important function of the bourgeois state in the market, and the UCC has created a means of obtaining priority called perfection. Generally the first of the secured creditors to perfect gets the priority. There are five means of perfection: (1) filing the claim with a government record like the state’s UCC office; (2) holding possession, like a pawn shop; (3) holding control, like being a co-signatory of a bank account; (4) levying on the property in pursuit of collecting a judgment; and (5) the topic of this post, a purchase money security interest.

Purchase money security interests (PMSI) are security interests in goods purchased with financing provided by the creditor. For example, your credit card company generally has a PMSI in the goods you buy with the credit they have extended to you. Rent-to-own companies (or their financial partner) usually have a PMSI in the goods they are leasing. As you may have gathered from these examples, PMSI usually arises in commercial lending, both with consumers and businesses.

But PMSI is not simply another means of perfecting a security interest. It has two unique factors: it is automatically perfected for consumer goods and it wins over all other security interests. This “automatic perfection” means that it obtains its priority upon attachment through UCC § 9-309: attachment occurs whenever (1) value has been given, (2) the debtor has rights in the collateral at issue (i.e. they have possession to it), and (3) there is a security agreement describing the collateral. Most basic sales contracts will satisfy the requirements, but to be extra careful the transaction usually occurs with the creditor formally making the purchase rather than the debtor. For example, in the recent important consumer protection case of Silva v. Rent-A-Center, Inc. it was Rent-A-Center’s bank, not Rent-A-Center, that held the security interest in the computer at issue.

Circuit-Breakers and King-Makers

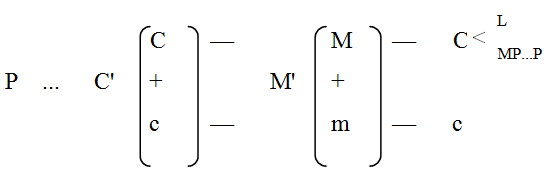

So now that we know what PMSI is and how it comes about, why would the state give it priority under such determinations (while non-consumer secured transactions are a bit more complicated than I want to get into here, PMSI generally has a priority there as well). In Marx’s second volume of Capital, he takes his infamous deduction of M-C-M’ (arrived at in Volume 1) and extracts out its component parts for the purpose of analyzing them:

Here P (productive capital) combines with c (surplus value) to form C’ (commodity capital). C’ in turn has its value realized in M’ (money capital), which in turn can be broken down into M (the realized value of P in money-capital) and m (the realized value of surplus value in money-capital). M can be reinvested into C (capital), comprised of L (labor) and MP (means of production). C can then serve as P and start the circuit all over again.

But this is but one formulaic expression. Marx identifies three (Tc=total circulation process):

1. M — C … P … C’ — M’

2. P … Tc … P

3. Tc … P (C’)

He is not just doing this as a basic exercise of algebraic substitution. It is to illustrate the three simultaneous modes of the circuit: to accumulate capital, to perpetuate itself through the continuous production of productive capital, and to make commodities. While the accumulation of capital is the most focused on by both Marxists and neoclassical economists alike, Marx is clear that consideration of it alone would be an error.

If we combine all three forms, all premises of the process appear as its result, as a premise produced by it itself. Every element appears as a point of departure, of transit, and of return. The total process presents itself as the unity of the processes of production and circulation. The process of production becomes the mediator of the process of circulation and vice versa.

The process of capital accumulation does not just happen to make commodities, and the production of commodities does not just happen to make profit. In capitalism, these processes are bound up in each other.

So let’s return to the subject at hand. PMSI are particularly interesting secured transactions to look at in terms of simple reproduction as illustrated here because of their specifically defined place in Marx’s third formula. PMSI exists to facilitate the purchases of commodities that would not otherwise be purchased due to deficiencies of capital. Let’s do a hypothetical (and for the purposes of this we will stick to Article 9 and not deal with any of the state or local laws).

Katie Brendan has decided to get a car. Feeling a bit fancy with her new corporate law debt collection job, Brendan decides to get a 2014 Bentley. Priced at $149,988, she pays a down payment of $25,000 and signs up for a two year payment plan of $5,388 per month at 3.29 APR. In other words, she is getting a loan of $124,988 which the auto dealer finance company has a PMSI in (with the collateral being, of course, the beautiful Bentley).

Unfortunately things take a turn for the worst for Brendan. Only 8 months into her job and she realizes that she has a conscience and cannot continue to work for her law firm. Brendan loses her job, and soon thereafter falls through one of those scary sidewalk grates. She injures herself and, having lost insurance through her employer, goes into a lot of medical debt. Brendan had seen those tacky commercials about free money now regardless of credit AND getting to keep your car, so she took out a car title loan using her Bentley.

But this was not enough to pay all her bills, and she falls behind on her payments for both her original financing for the car and the title loan. As we now know, the original financing as a PMSI will win out in priority over the title loan. Despite the title loan also being a secured transaction, they end up with nothing.

How is this result in line with the function of the capitalist free market? Because PMSI is a loan of purchase capital. While both loans technically have the same collateral (the Bentley), they have a different relation to that collateral. The PMSI mediated the realization of the Bentley, as commodity-capital, into money-capital for the auto-dealer. All the title loan did was give a consumer money. Further, the type of consumers getting something like a car title loan are not exactly driving the consumptive process: they’re often paying off bills, sometimes as in this case on the very collateral they are putting forward. And that’s the economic role of these bottom-feeders of capitalism. Rather than making loans of productive capital, they make loans are either realized in payments or, when defaulted, on returning the collateral to the circuit as commodity-capital to be liquidated or resold.

It is easy from this description, as well as the priority given by the law, to think of PMSI as somehow more noble than other secured transactions. But PMSI can be just as, if not more, destructive and exploitative even in its role of pushing forward the circuit. Especially with the plethora of subprime lending available to the modern consumer, a PMSI loan can be made to a person with no ability to pay. It continues the circuit of capital with, as Marx calls it, “fictional money-capital.” This can be catastrophic enough when it is a single transaction (with the original financing company having to expend productive capital to realize the money-capital of repossessing the Bentley), but when many such transactions are packaged into securities…

A Socialist PMSI?

A savvy preacher of the free market might realize that this problem of PMSI could be broader than money-capital and capitalism itself. After all, what is fundamentally being discussed here is investment prior to realization. Assuming the abolition of capitalism and the implementation of some kind of centrally planned socialism, there would still be a need to make such investment decisions prior to realization with the possibility of such decisions causing problems. For example, if the Party decides that memes are a universal human right (as well they should) and orders the production of smartphones for the world’s populace to facilitate this right, the coltan may be mined and brought to the factory but an emergency asteroid strike has the europium for the phones re-purposed into a giant laser to take out the asteroid. The coltan could be sitting around for weeks or months before new europium is acquired, or the coltan could be re-purposed for other uses and the whole process begins all over again.

But this hypothetical illustrates (admittedly in a silly fashion) what would be the central difference between investment and returns in capitalism and in socialism. In capitalism, prioritization is given to continue the cycle and thus continue accumulating capital and producing commodities. In socialism, prioritization would be given based on human benefit, labor, and sustainability. As much as I strongly stand by universal access to memes, it is clear that stopping an asteroid is a higher priority. By making such decisions democratically and empirically, socialism could avoid the sort of destructive downturns inherent to capitalism, as well as its lack of ecological sustainability. But the process of making those decisions will be left to a later post, which will attempt to formulate what a proletarian state would look like legally.

Like this post? Consider tipping the author $1 or $5. Think it is brainwashed pinko nonsense or maybe revisionist counter-revolutionary propaganda? Feel free to leave a respectful comment.

2 thoughts on “Capitalism’s Insecurities”